indiana real estate taxes

The information provided in these databases is public record and available through public information requests. Taxes in Indiana are due annually in 2 installments due in.

Business Personal Property Tax How To Maximize Your Efficiency

Generally a sweeping appraisal technique is used with that same methodology applied across the board to similar.

. Taxes are due and payable in two 2 equal installments on or before May 10 and. The Indiana Department of Revenue does not handle property taxes. The median annual property tax paid in Indiana is 1263 which is about half that US.

In Indiana aircraft are subject to. The exact property tax levied depends on the county in Indiana the property is located in. Indiana Gateway Local Tax.

Indiana County Tax Assessment Office Indiana County Courthouse Second floor 825 Philadelphia St. The Department of Local Government Finance has. Main Street Crown Point IN 46307 Phone.

Property taxes in Indiana are paid in arrears meaning the taxes paid in the current year represent the taxes owed for the previous year. This service only accepts one-time full or partial payments made with ACHeCheck and Credit Card. Taxes involved in Bankruptcy.

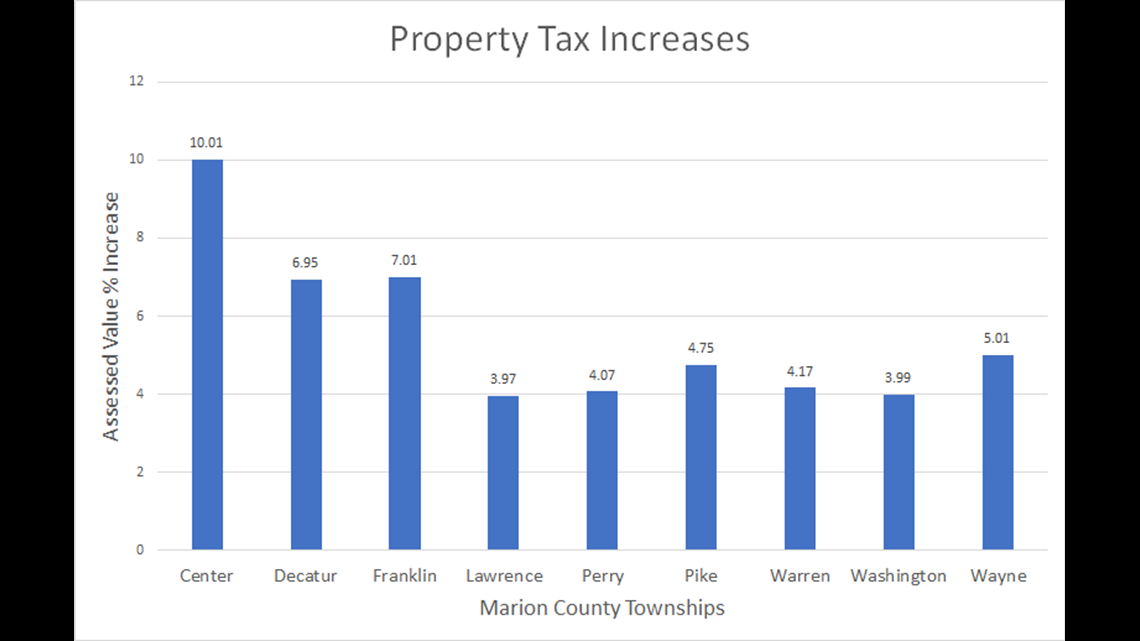

2022 Budget Order - All Montgomery County Units. Provides that for each calendar year beginning after December 31 2021 an annual adjustment of the assessed value of certain real property must. Hamilton County collects the highest property tax in Indiana levying an average of 227400.

The statewide average effective. Conduct Annual Tax Sale pursuant to Indiana Statute. Pay Your Property Taxes.

Real Estate Property Tax. In order to calculate your tax bill your net assessed value is multiplied by your local tax rate of 07090. Statements are mailed one time with a Spring A coupon and Fall B.

2021 County Budget Ad - Requested Amounts Form 3 2019 Pay 2020 Local Tax Conservancy and Credit Rates. 2019 pay 2020 property taxes are due May 11 2020 and November 10 2020. In Indiana tax rates are calculated on a per 100 basis.

Please direct all questions and form requests to the above agency. Indiana laws prescribe new property assessments on a recurring basis. This means that for every.

Various Vigo County offices coordinate the assessment and payment of property taxes. If you have an account or would like to create one or if you. Tax deadline for 2020 realpersonal taxes.

Billing and Collections of Property taxes Real Estate Personal and Mobile Homes. The state of Indiana has a flat income tax rate of 323. Randolph County Start voice input.

Indiana County Chief Assessor Frank E. Signup to get updates in your email from the state. An official website of the Indiana State Government.

For those who pay the tax within 30 days of the due date and do not owe back taxes on the same property the penalty. Indiana has relatively low property taxes. Create a Website Account - Manage notification subscriptions.

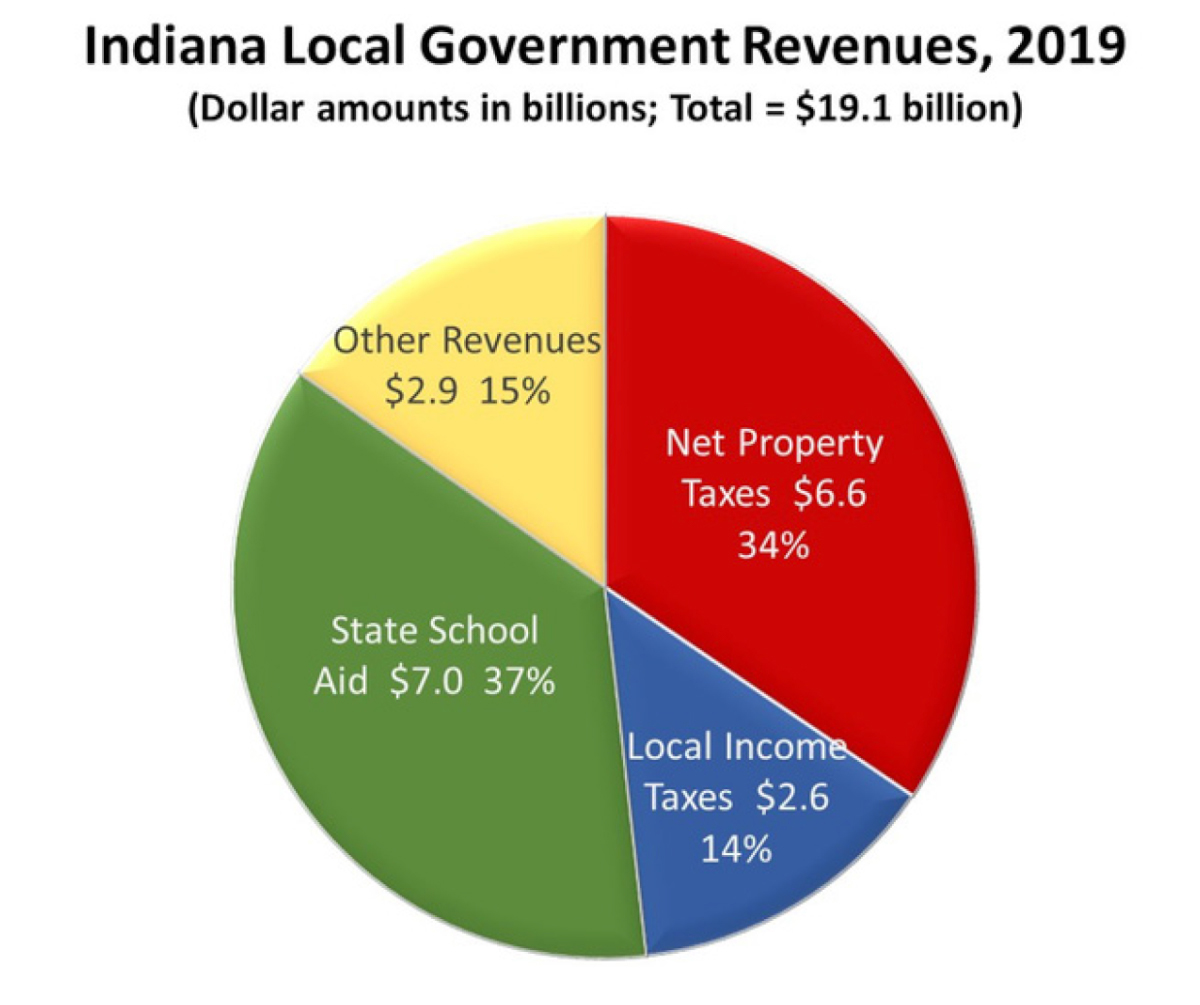

However its somewhat misleading since there is an additional 035 to 338 local tax. Property Taxes Due Fall Property Taxes are due November 10 2022 Read On. Local Income Taxes Indiana.

Taxpayers who do not pay property taxes by the due date receive a penalty. Property tax increase limits.

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

The Ultimate Guide To Indiana Real Estate Taxes

The Story Of Why Real Estate Taxes Are Paid In Arrears And How Property Tax Prorations Work Chicago Real Estate Closing Blog

Here S A Reminder That Indiana Property Taxes Are Due May 10 Eagle Country 99 3

State Lawmakers Eye Business Tax Cuts Indianapolis Business Journal

Berkshire Hathaway Agent Hoping To Lure Cook County Homeowners To Northwest Indiana Crain S Chicago Business

Tangible Personal Property State Tangible Personal Property Taxes

Indiana Real Estate Continuing Education Real Estate Taxes

Deducting Property Taxes H R Block

Additional Information On Property Taxes

Innovative Property Tax Solutions Facebook

Ranking Property Taxes By State Property Tax Ranking Tax Foundation

Indiana Property Tax Calculator Smartasset

Are There Any States With No Property Tax In 2022 Free Investor Guide

Real Property Taxes Plews Shadley Racher Braun

How Taxes On Property Owned In Another State Work For 2022

Does Inability To Pay Property Taxes Lead To Losing Your Home Mansion Global

Threats To Local Government Revenues From The Coronavirus Recession Purdue Ag Econ